Mobile Gaming Founders Blazing New Trails

One of the best things about working at Silicon Valley Bank in Los Angeles is the access to amazing founders and companies. Since we’re deeply focused on the innovation ecosystem and bank over 50% of venture capital-backed companies, I have the luxury of seeing trends across the startup ecosystem. This blog post highlights a trend I’m seeing here in Los Angeles: Established mobile gaming founders are leveraging their deep mobile expertise, including performance marketing, into new non-gaming verticals. Because mobile gaming was the first category to dominate the App Store, these entrepreneurs are leveraging their 10+ years of experience to create a distinct advantage.

Mobile games: The App Store’s bread and butter

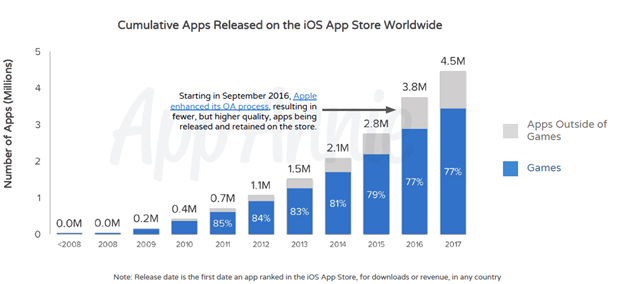

Mobile games have dominated the App Store, though other categories are growing. App Annie recently published a report that clearly shows this trend: game apps have typically represented over 80% of the apps released in the iOS App Store.

As a result, mobile gaming companies are, by and large, more advanced in their monetization and marketing capabilities

Even though we are seeing growth by non-gaming apps, the revenue disparity between gaming and non-gaming apps is huge. In 2017, of the 30.5 billion apps downloaded from the iOS App Store, games accounted for only 31% of total downloads but represented 75% of consumer spend (includes fees to download, in-app purchases and in-app subscriptions).

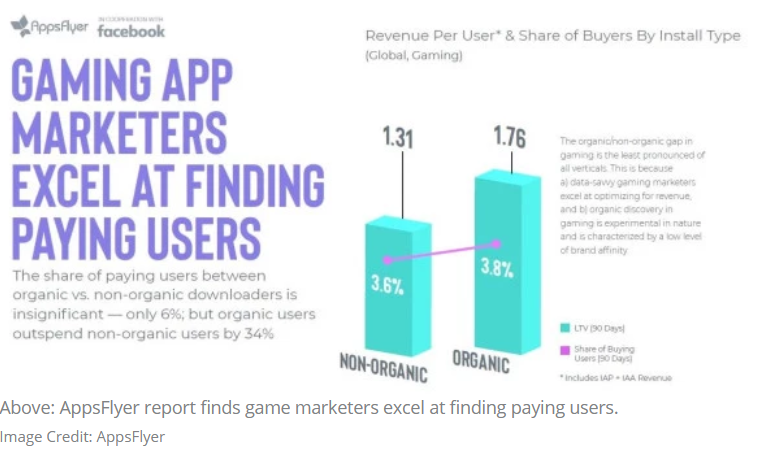

As founders who have released mobile consumer apps know, a significant amount of focus is on lifetime value (LTV) and customer acquisition costs (CAC), including organic and paid acquisition, retention and churn. Since mobile games have dominated the App Store for a long time now, mobile gaming founders have, by and large, written the book on mobile performance marketing. And the data proves it — AppsFlyer completed a study that shows mobile games have nearly an equal amount of non-organic buyers as organic buyers — demonstrating that gaming companies are adept at acquiring quality, non-organic buyers. And this comparison is drastically better than the comparison seen between organic and non-organic buyers in other non-gaming categories. While the 90-day LTV for organic buyers is 30% higher than non-organic buyers in gaming, the variance is negligible compared to a near 300% difference in shopping and 60% in travel.

VentureBeat summarized this report by saying, “The share of paying users in gaming is only 6 percent higher for organic users compared with 25 percent higher and no less than 170 percent higher for travel and shopping, respectively. A key reason for this significant gap is the much heavier use of data among gaming app marketers.”

Mobile gaming founders leveraging know-how in new verticals

I’m seeing a consistent pattern now, where established, experienced mobile gaming founders are leveraging their know-how into new verticals with success. Below are a few examples:

Embrace is an enterprise software company that has developed a mobile app performance monitoring (APM) platform which can discover performance issues like those due to code, integration with software development kits (SDKs), network calls, poor connections or user error. One of the co-founders, Eric Futoran, previously co-founded Scopely, which has raised over $250M to date and is one of the more established mobile gaming companies in LA. At Scopely, Eric built and managed the publishing business which included customer acquisition efforts — which was a perfect segue to his next act: building a tool that would arm performance marketers with the mobile app performance issues that, once resolved, immediately lower churn and increase LTV. Embrace has hired a deep bench of mobile experts from Scopely, Kontagent, Tinder and Whisper. And with their deep mobile experience, they have laid out a product roadmap that allows for non-gaming companies to move up the mobile learning curve quicker.

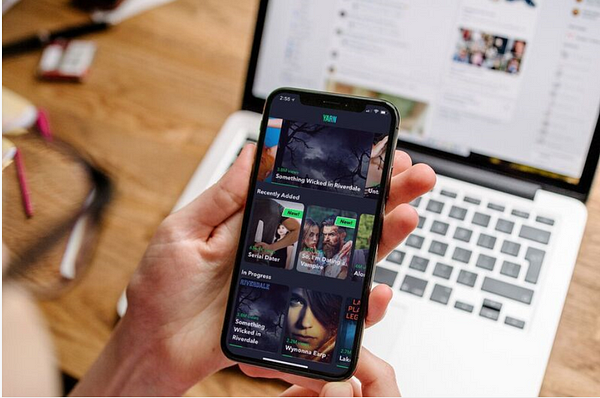

Mammoth Media is another prime example of this trend. Founder and CEO Benoit Vatere, was previously the CEO of Playhaven, which developed tools to enable mobile developers to intelligently acquire, engage and monetize users. While at Playhaven, Benoit saw how data modeling could accurately predict LTV. He also observed what happened to gaming companies like Zynga, which failed to own their distribution. When digital media companies started to largely rely on social media for distribution, he saw an opportunity (read more about the State of the Digital Media Market, in my previous blog post here). Mammoth Media has since launched three apps — Yarn (micro-storytelling app), Wishbone (social polling app) and Arena (a live trivia battle app). All three apps reach millions of monthly active users and regularly land in the App Store’s Top 100 charts in the US across categories. The Mammoth Media team is successfully leveraging its mobile gaming know-how both in revenue models (like in-app purchases) and the data science behind performance marketing, and is redefining the future of entertainment by bringing the TV network model to mobile and merging its technology startup background with the Hollywood scene.

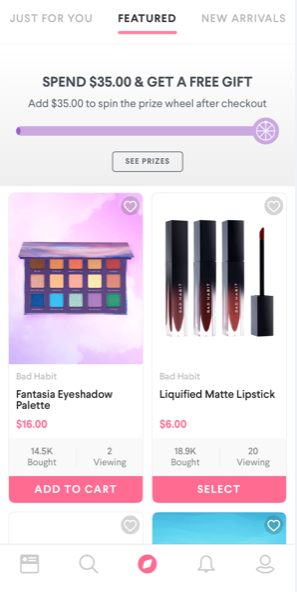

Prize wheel highlighted at top of image

Hush is a mobile-first company that allows users to discover, share and shop beauty products. Co-Founder and CEO Alex Lin, previously founded Lvl6, a mobile social game developer. He is now leveraging his gaming experience in the beauty category, disrupting large, primarily brick-and-mortar companies, like Ulta Beauty — a company valued in excess of $14 billion.

His prior experience in gaming made him understand the importance of building community due to its impact on retention and LTV. As a result, Hush has built a discovery section within the app that allows users to post content (usually showcasing their makeup skills or reviewing products). This has created a freshness of content that increases daily usage and builds community. Hush has also included gamification features in its app — like allowing users to spin a virtual wheel to win a free prize if you spend $35 or more. Although traditional e-commerce companies may see these features as unorthodox, these tactics are working for Hush.

The intersection of commerce and gamification in mobile commerce = Fertile ground for mobile gaming founders

Why are we seeing ex-mobile gaming founders in new mobile verticals? Because the market is HUGE and GROWING! One of the largest opportunities is in mobile commerce.

In Q4 2017, comScore reported that U.S. shoppers spent $131 billion, of which only 24%, or $32 billion, came from mobile devices (smart phones and tablets). Mobile sales grew 40% year-over-year in Q4 2017, while desktop sales grew by 15%. Ryan Williams, Head of Client Insights, Retail, Travel and CPG at comScore says, “Mobile is the key driver of digital retail growth.” He goes on to highlight, “…mobile sales lag behind their share of time spent on site, as mobile devices account for 64% of minutes on a retail site but only 24% of dollars.” Business Insider forecasts that by 2020, mobile commerce will be comparable in size to e-commerce.

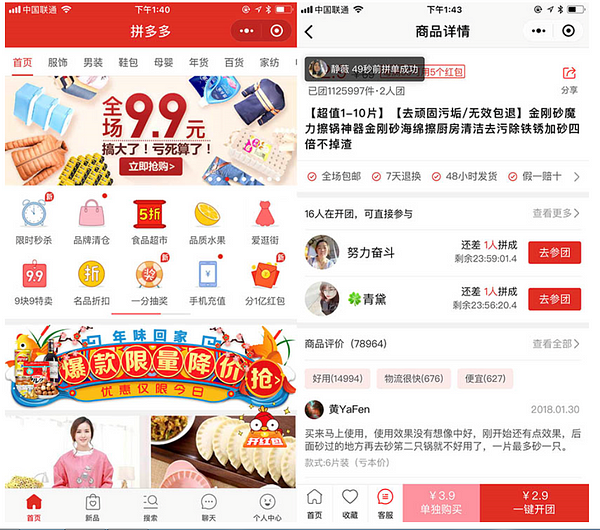

Screenshots from Pinduoduo show low-price goods, and customers using the group-buy function.

How far could mobile dominate commerce? Well, let’s look at China as an example. Alibaba generated over 90% of its sales on mobile in 2017! Of course, China is a truly mobile-first country so it’s not 100% fair to compare them to the U.S., but the figures are still amazing. In my conversation with Alex Lin, he wisely brought up Pinduoduo (PDD) as an example of a mobile commerce company successfully leveraging gamification features and community. PDD, a company that describes itself as “Costco meets Disneyland”, combines value and entertainment in a new e-commerce platform that uses a ‘team purchase’ model where product information is shared through social networks by family, friends and social contacts who form shopping teams that have access to lower prices. The company has 100 million monthly active users in just three years and just completed an IPO valuing the company close to $20 billion. Incredible!

As the non-gaming app market continues to grow, many of the same variables that mobile gaming companies focused on — namely building community and focusing on the performance marketing — will also be critical. And my guess is that many of these companies will rely on the 10-year+ know-how of sophisticated and successful mobile gaming entrepreneurs to gain a competitive advantage.

Based in SVB's Santa Monica office, Managing Director Alejandro (Al) Guerrero works with portfolio companies and their management teams to help them build their vision for the future and succeed. Al’s experience in business creation, business and corporate development and investing, when combined with his proven ability and passion for increasing profits helps him work with early-stage tech startups throughout Los Angeles’ thriving ecosystem. He’s especially looking forward to leveraging more than a decade of experience in the Media & Entertainment vertical to help move forward some of LA’s most innovative companies.

Tony Greenberg

Tony Greenberg

Ivan Nikkhoo, Managing Partner – Navigate Ventures

Ivan Nikkhoo, Managing Partner – Navigate Ventures Michael Sherman, Neil Elan and Karine Akopchikyan

Michael Sherman, Neil Elan and Karine Akopchikyan Alejandro Guerrero

Alejandro Guerrero Eric Eide, Alliance for SoCal Innovation

Eric Eide, Alliance for SoCal Innovation Kevin DeBre

Kevin DeBre Braven Greenelsh

Braven Greenelsh Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank

Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank Braven Greenelsh

Braven Greenelsh Kaäre Wagner, Silicon Valley Bank

Kaäre Wagner, Silicon Valley Bank Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank

Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank Sid Mohasseb

Sid Mohasseb William Hsu

William Hsu Braven Greenelsh

Braven Greenelsh Dinesh Ravishanker

Dinesh Ravishanker Dina Lozosfky

Dina Lozosfky Melinda Moore

Melinda Moore Ivan Nikhoo

Ivan Nikhoo Jaspar Weir

Jaspar Weir Erik Caso

Erik Caso Tracy Olmstead Williams

Tracy Olmstead Williams Dave Berkus

Dave Berkus Bernard Luthi

Bernard Luthi Peter Cowen

Peter Cowen Nick Hedges

Nick Hedges Eric Larsen

Eric Larsen Michael Terpin

Michael Terpin Steve Reich

Steve Reich